How to WIN when uncertain

![]() Ben Streater on 09 Apr 2020

Ben Streater on 09 Apr 2020

The dramatic daily movements in markets are making investors and advisers anxious. In the past three weeks for example, the ASX 200 had its largest single day fall since 1987 of 10%, and the largest single day gain in 40 years of 7%. Further, the diverse range of views from media and industry commentators adds additional confusion to the situation, exacerbating investor anxiety and fear.

How then can an investor win during times of heightened and exacerbated uncertainty? In this article we present a solution designed to generate a return whether the market moves up or down, known as the “Twin-Win”.

What are Twin-Wins?

Twin-win payoffs are structured products that generate a positive return in both bullish as well as bearish markets. It is only when markets fall below a specific level that investor capital is at risk. This however can be mitigated by designing the product with deep defensive barriers to reduce the chance of loss.

We spoke with Managing Director & Global Head of Sales of WallStreetDocs, Tiago Fernandes, on the structure’s utility and popularity by affluent investors. Fernandes also served as the former head of SRP – the global association for Structured Products, observing and documenting various trends in the global structured product marketplace.

“The twin-win has seen success in countries like Switzerland, Mexico and the US as they have been commonly embraced by more sophisticated investors and private banks.”

On the use of Twin-Wins globally, Fernandes saw that the products were a constant presence in the US structured product market but more recently its popularity has surged.

“In the past two years the average monthly sales in the US was $60 million. This figure has now risen to $100 million per month.”

When asked on the reasons behind this, Fernandes commented:

“The 40% rise in monthly volumes appears to be driven by two things; Investors uncertainty is at record highs, and, market volatility is at record highs which has improved the attractiveness of the payoff from a risk/return perspective.”

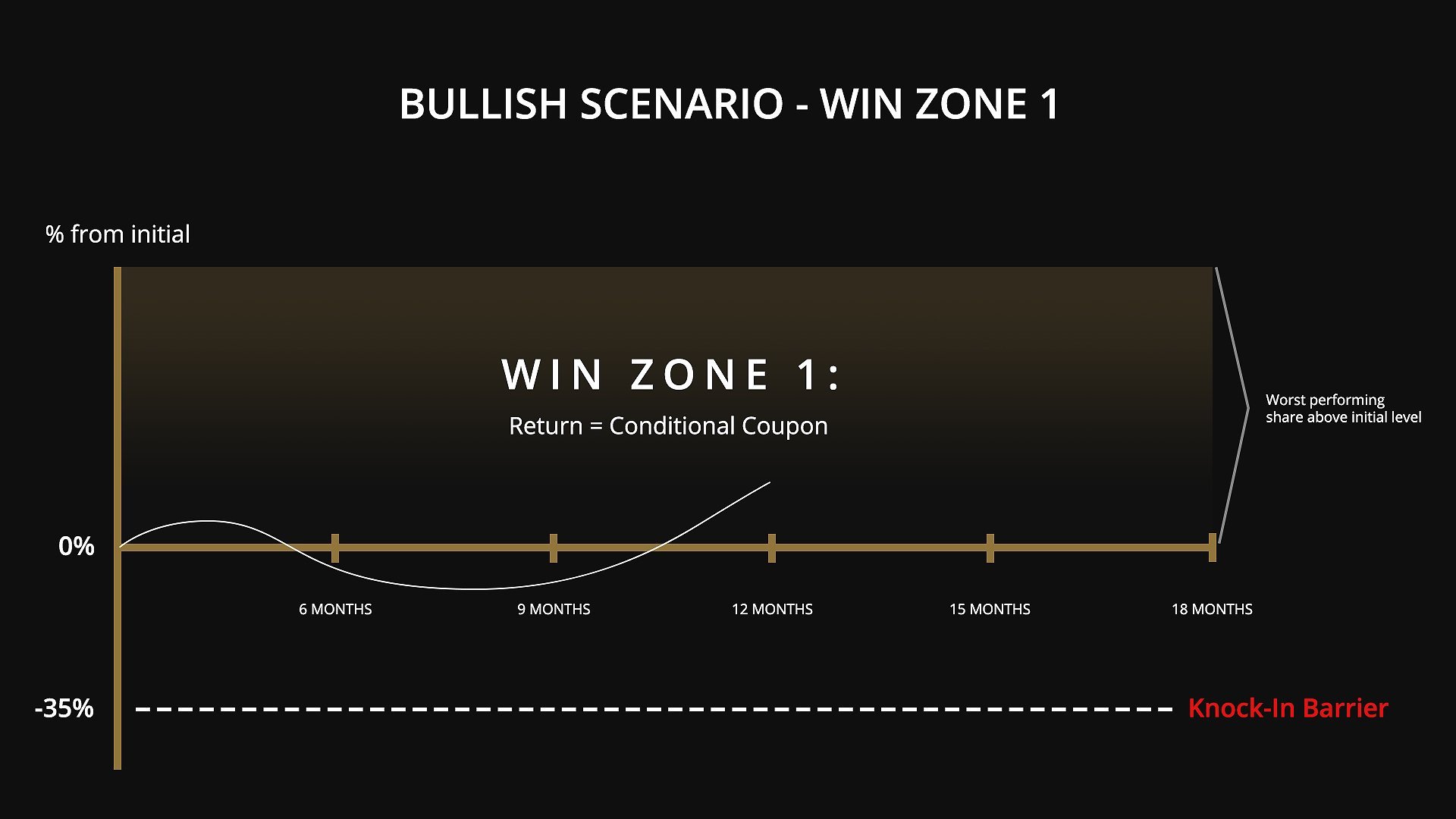

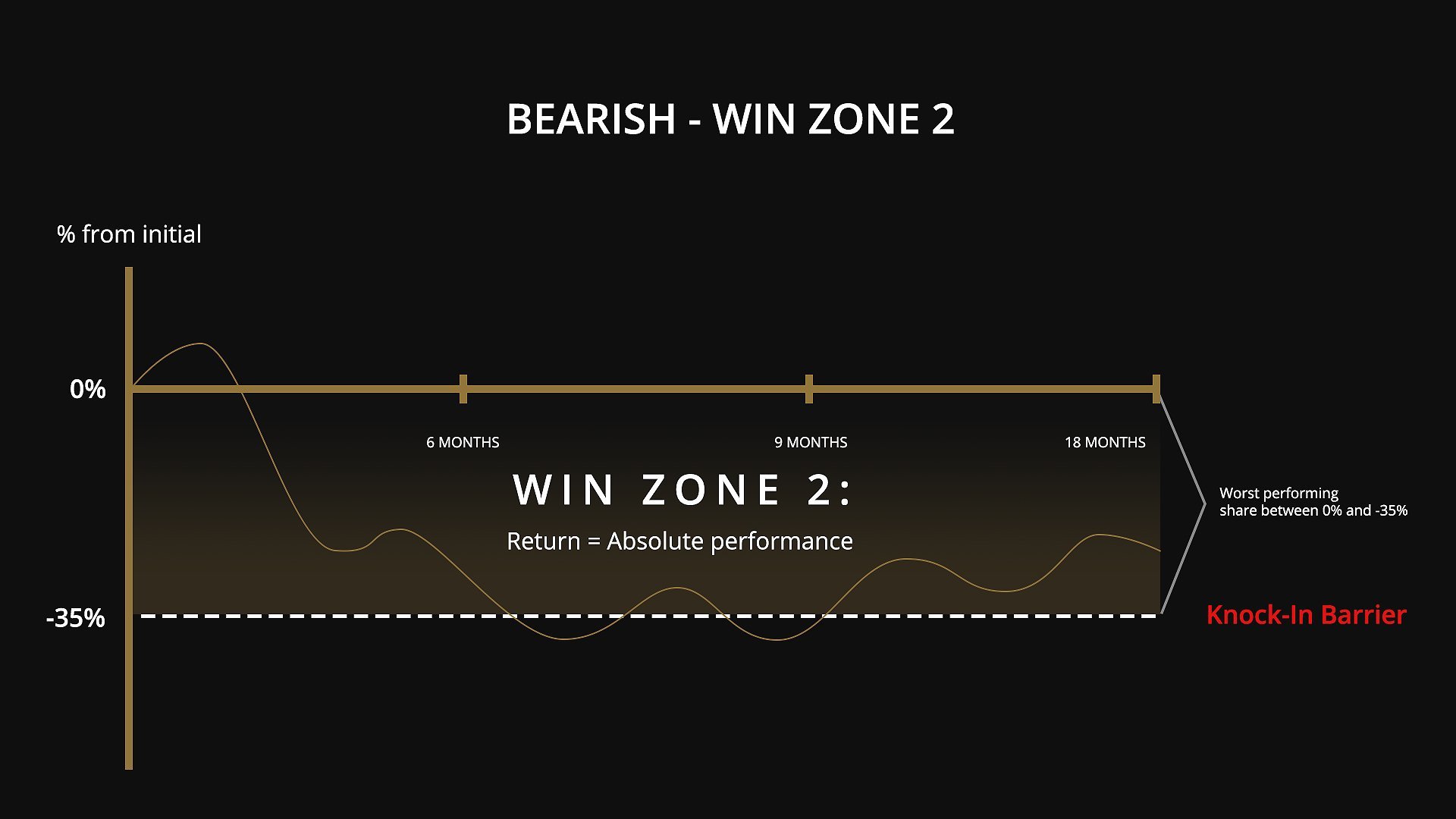

To understand how the Twin-Win works, it’s helpful to understand how it performs under different market scenarios. In a bullish scenario, when the underlying share prices are above their initial levels, the investor will typically receive a ‘conditional coupon’ (Win Zone 1 below). In a bearish scenario, the investor will receive a return equal to the downside performance of the underlying shares (Win Zone 2). This is known as an absolute return.

In the worst case scenario, where the underlying shares fall significantly from their initial price and breach a Knock-in Barrier, the investor is exposed to the performance of the underlying shares (Loss Zone).

Twin-Win Example

Below is a summary of a Twin-Win investment available on the Stropro platform.

Summary of terms:

Underlying assets: BHP & Rio Tinto

Term of investment: 18 months

Conditional Coupon: 16% p.a. (indicative)

Knock-In Barrier: -35% observed at maturity

We will now work through the three market scenarios to demonstrate how the Twin-Win performs in each. It is important to note that this particular structure is tracking the worst performing of the two shares and the Knock-In Barrier is only observed at maturity.

This product was built with a ‘callable’ feature. The callable feature is observed every quarter from 6 months (call date). This means if the stocks are above their initial levels on a call date the product matures early and the conditional coupon is paid.

Win Zone 1: Both shares are above their initial levels on a call date (this occurs at the 12 month mark).

Outcome: Investor receives the conditional coupon of 16% p.a.

Win Zone 2: Worst performing share finishes below initial level, for example 20% below.

Outcome: Investor receives the absolute performance of the worst performing share, in this case a 20% return paid at maturity. (Note the barrier is breached during the term but has no impact on investor capital as the observation is at maturity).

Loss Zone: Prices have crashed and the worst performing share finishes below the -35% knock-in barrier at maturity, for example 40% below initial level.

Outcome: Investor receives performance of worst performing share, in this case a 40% loss would be suffered.

As the above example demonstrates, for investors who are unsure on the direction of where markets might be headed, the Twin-Win is a strategy worth considering due to the structure’s ability to generate a return in volatile market scenarios.

For further information about ‘Twin-Win’ structured products or other structures on the Stropro Platform, please visit www.knowledgehub.stropro.com and register an account. After successful registration and approval, you will be able to view active and planned investments. The Stropro Knowledge Hub is easily accessed from the Stropro website for anyone looking to build their knowledge and understanding of Structured Products.

Stropro is an investment platform for wholesale and sophisticated investors where you can access Structured Products issued by investment banks. The tactical investment opportunities we arrange are generally defensive and focused on generating enhanced returns regardless of the economic conditions. In times of economic volatility these Structured Products can be particularly attractive. Our view is that Structured Products belong in all sophisticated investor portfolios and should make up approximately 5% of your portfolio allocation.

Ben Streater is the Chief Product Officer at Stropro. This article is for educational purposes and is not a substitute for professional and tailored financial advice. This article expresses the views of the authors at a point in time, which may change in the future with no obligation on Stropro or the author to publicly update these views.