The Alternative Advantage: Harnessing Diverse Growth Opportunities in 2023

![]() Stropro on 30 Apr 2023

Stropro on 30 Apr 2023

.png)

Key Takeaways

Persistent inflation has complicated the Fed's policy decisions

Big Tech as Safe Haven amidst economic uncertainty

With market volatility and economic instability posing challenges, it may be time to diversify into alternative investments

Explore where financial institutions see the greatest potential in private markets for future outperformance in 2023

Market Outlook

From Stropro's Investment Team

As we wrap up May, a variety of economic events have unfolded. From an AI boom sparking a chip shortage, big tech stock dominance, and strong consumer spending to stubborn inflation - these developments have painted a complex economic picture.

Let's quickly breakdown the specifics:

Artificial intelligence hype is fueling big techs dominance

In our previous newsletter, we highlighted the attractiveness and dominance of big tech stocks. Big tech companies’ mature business models, brand presence and consistent cash flows have carved out their position as a safe haven due to their robust balance sheets amidst economic uncertainty. As such, large cap stocks have seen record inflows. We also mentioned that their size and organisational structure provides them the agility to leap on new megatrends, such as Artificial Intelligence.

Nvidia CEO, Jensen Huang, has capitalised on this trend by unveiling an array of new AI products and services, positioning Nvidia at the heart of the AI rush. Further, the rise of AI has led to a severe chip shortage, in a similar fashion than early pandemic scramble for toilet paper. Nvidia’s recent earnings call showed a 44% increase from the previous quarter, with an estimated guidance for a 33% increase in revenue for the next quarter. This leap has led to Nvidia leading the charge towards a $1 trillion market cap amidst this scarcity.

Does this AI Boom warrant Nvidia’s Forward Price Earnings Ratio of nearly 200? Potentially not, but betting against big tech is a tried tail of how to lose money.

As markets stop doubting the Fed, companies are starting to struggle.

Persistent inflation has catalysed the Fed's most aggressive rate hike campaign since the 1980s. As BlackRock points out, markets are moving away from expecting repeated Fed rate cuts, acknowledging inflation's tenacity.

The effects of central banks' rate hikes are now in full swing. For example, Germany has slipped into a recession, while the U.S., despite stable GDP growth, might arguably be in a recessionary phase based on gross domestic income.

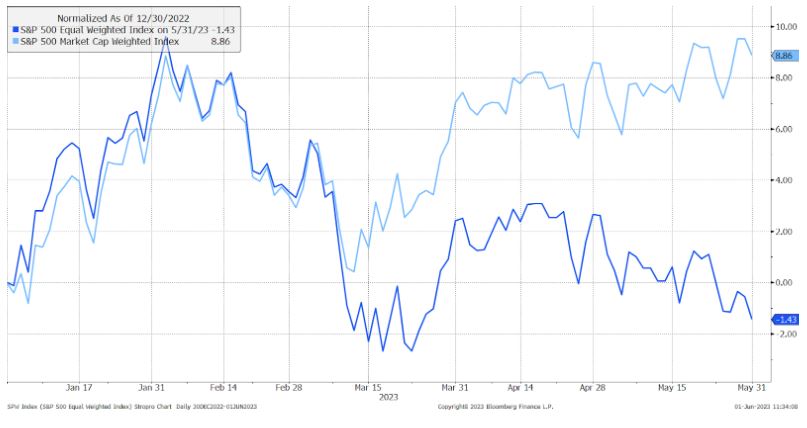

Echoing our past commentary, a deeper look reveals that the S&P 500 index's near 10% gain this year is driven by a few large tech firms benefiting from the AI buzz. However, when all companies in the index are weighted equally regardless of size, it indicates a decline of over 1% this year.

2023: A Year of Surprises

Who predicted the Nasdaq 100's 26% rise in H1 of 2023? No one. The common consensus leaned towards a weak H1 and a recovery in H2. Yet, the first half has defied these expectations.

When investors realised they could move beyond the 0.01% earnings in savings accounts, capital poured into money market funds yielding ~5%. This flight to money markets was the second dagger in the back of some regional banks, who thought their depositors were sticky and loyal. The first dagger was of course a rapid rise in interest rates which slashed the value of their long term assets, leading to major liquidity constraints.

We also think some of the talking heads in the VC community deserve a bit of blame… bank runs are driven by fear, and instead of providing comfort, the likes of Peter Theil aided in tipping the first domino in a chain of events leading to the collapse of Credit Suisse..

A collapsing banking system still didn’t phase the markets, instead, tech stocks rallied, shielding major indexes from the impact of regional bank losses. Tech has had an impressive run - but how long will it last? Will the frontrunners keep leading or is it time to change course?

Another winner this year has been, you guessed it… alternative investments. While demand for VC and PE hasn’t picked back up to its 2021 levels, Hedge funds and Private Credit are having a stellar 2023. With HF’s bringing in over $9.1b inflows in Q1 2023.(HFR) and Blackstone having seen a 9% YOY increase in AUM of their Credit Strategies.

Global institutional and ultra-high net worth investors recognise one thing, going long on risky assets may not be the reliable strategy it has been since 2010. There’s an overarching consensus that growth may be subdued going forward as we deal with the hangover induced by loose monetary policy.

Alternative Investing: A Path Through Uncertainty

Following a challenging 2022, where nearly all asset classes, including traditionally stable ones like U.S. Treasuries, posted losses, investors are actively exploring avenues, including alternative investments, to revitalise their portfolios in 2023.

Supplementing a traditional portfolio with alternative assets can tame volatility and amp up risk-adjusted returns. J.P. Morgan's research shows a reallocation from a 60/40 portfolio to a 30% alternative, 40% equities, 30% fixed income mix can push annualized returns from 8.39% to 9.04% and cut volatility from 9.66% to 7.97%.

Breaking down the classics

Hedge funds: The volatility and divergent global monetary policies of 2022 paved the way for alternative investment strategies like multi-strategy, macro, and CTAs (commodity trading advisors) within hedge funds to thrive.

Last year, we saw a growing gap in performance, with the biggest and most established institutional firms outpacing their peers. These heavyweight players, backed by comprehensive teams, systematic trading infrastructure, and sturdy risk management systems, the challenging market conditions of 2022. In contrast, many smaller, emerging managers struggled. While smaller hedge funds have enjoyed some recent successes, the evolving economic climate has favoured larger funds, and this trend could potentially carry forward into 2023.

As we discussed earlier, there has been immense divergence in the performance of S&P 500 companies, providing more opportunity for equity long-short hedge funds to generate outperformance.

Private Markets: According to J.P. Morgan's MD and Global Head, Jay Serpe, they see fresh opportunities arising in private markets this year as volatility continues and valuations get more attractive. History supports this view. Bain & Company, Global Private Equity Report 2023 highlights managers that launch funds in periods of economic stress and market volatility tend to outperform. This can be attributed to managers acquiring assets at attractive prices and securing better deal terms by providing capital when it is more costly and difficult for companies to obtain it.

Several areas in private markets are providing compelling entry points here is a comprehensive list of a few ones:

Deal flow opportunities are expected to increase for younger buyout private equity funds : Volatility in public markets is creating opportunities for private equity. Asset valuations in private equity typically lag public markets, meaning prices for large, industry-leading private companies are becoming more reasonable. The decline in the volume of initial public offerings (IPOs) globally means companies may stay private for longer, increasing the deal flow for private equity managers with available funding.

Secondaries are taking great assets at discounted valuations, thanks to institutional demand for liquidity: A reduction in IPOs has led to reduced liquidity events for high-performing older PE vintages. This scenario creates opportunities for secondaries funds to acquire discounted stakes in these high-quality funds from cash-hungry institutions. The advantages of investing in secondaries are substantial: Investors can tap into a portfolio of mature funds that offer extensive diversification and are nearer to capital returns. Furthermore, secondaries can provide clear insight into a fund's underlying asset portfolio.

Venture Capital and Growth Equity are set to benefit from all-new megatrends and cheaper valuations: These are sectors that offer access to industries that can be difficult to reach via public markets, such as AI, climate technology, and cybersecurity. According to CB Insights, last year, growth equity suffered the steepest decline in asset prices of any industry sector. With market volatility and capital scarcity, valuations in these sectors are expected to erode, and many companies will likely need capital in 2023. Managers with deep industry knowledge and networks, and experience investing through challenging periods for growth investing will be more likely to outperform.

Infrastructure is adventuring beyond dams and roads: Global shifts are creating entry points in the infrastructure markets. The need for new, non-traditional digital, environmental, or industrial infrastructure is increasing while traditional infrastructure assets still need to source additional financing. Data from J.P. Morgan estimates a US$3.6 trillion gap between infrastructure investment and the demand for fresh capital. This shortfall creates an opportunity for seasoned managers with specialised operating knowledge. For investors new to this asset class, it’s essential to work with experienced managers that can navigate the complexities of infrastructure types and ensure adequate diversification.

Private credit is thriving in times of credit tightness and increasing cost of capital: Rising uncertainty and diminished bond issuance in public markets are boosting the demand for private capital substitutes. For instance, high yield bond issuance plunged by 78% year-over-year between 2021 and 2022, and leveraged loan issuance tumbled by 70% in the same timeframe. Meanwhile, banks are experiencing liquidity issues not seen since the 2008 Financial Crisis. With traditional sources of credit financing becoming less available, more companies are turning to private credit. In periods of economic and market stress, private credit managers with capital to deploy can demand more favourable terms on the loans they provide. (Bain & Company, Global Private Equity Report 2023.)

Events & Press:

We were delighted to gather amongst a group of inspiring women who attended Stropro's 2nd Women in Investing Lunch, proudly hosted by BDO Sydney. It was an inspiring and insightful gathering highlighting the importance of female leadership, entrepreneurship, and driving positive change in early-stage investing.

Thank you to our incredible line-up of speakers including Cathryn Lyall - Partner at SeedSpace Venture Capital, Hannah Mourney - Analyst at Giant Leap, Grace Mathew - Managing Director at WeThink and Lilian Luu - Director at BDO.

Press: Anto speaks to Ausbiz: Generating Returns during a Recession

Anto shares his expert insight on the current market trends and the potential impacts they may have on structured investments. Access a snapshot of the landscape of the financial industry, and discover Anto's unique perspective on navigating these dynamic times. Watch the full video here.

Events: Celebrating Women in Investing and Driving Positive Impact

We were delighted to gather amongst a group of inspiring women who attended Stropro's 2nd Women in Investing Lunch, proudly hosted by BDO Sydney. It was an inspiring and insightful gathering highlighting the importance of female leadership, entrepreneurship, and driving positive change in early-stage investing.

Thank you to our incredible line-up of speakers including Cathryn Lyall - Partner at SeedSpace Venture Capital, Hannah Mourney - Analyst at Giant Leap, Grace Mathew - Managing Director at WeThink and Lilian Luu - Director at BDO.

What Caught Our Attention!

We wanted to share the following news and articles with you which we here at Stropro found interesting:

19-05-23 - AFR - Japan stocks extend rally to near 33-year high

16-05-23 - AFR - This could be rich families opportunity of the decade

Thank you for taking the time to read this update and we appreciate any feedback that you might have. Please reach out to the team at any time.

If you have any questions contact us at team@stropro.com.

Warm regards,

Stropro Team

This information is for educational purposes and is not a substitute for professional and tailored financial advice. This information expresses the views of the author(s) at a point in time, which may change in the future with no obligation on Stropro or the author to publicly update these views. This information uses information from sources the author considers to be reliable but does not represent that such information is accurate or complete, or that it should be relied upon. Past performance is not a reliable indicator of future performance. Investments may rise and fall in value and returns cannot be guaranteed. Stropro makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides. Stropro is a Corporate Authorised Representative (CAR No. 1277236) of Lanterne Fund Services Pty Ltd (AFSL No. 238198).